Cash advance banking institutions tend to deserve borrowers to write a cheque as well as get into choice if you need to in electronic format remove funds from their deposit, economic romantic relationship or prepaid justification. When they come back to the financial institution with insufficient income, that they face higher bills.

Any choices to better off convey a greeting card pay day, applying for with family or friends and commence financial counselling. Not for profit fiscal therapists may help arrive at possibilities that will work to the problem.

1. Great importance Costs

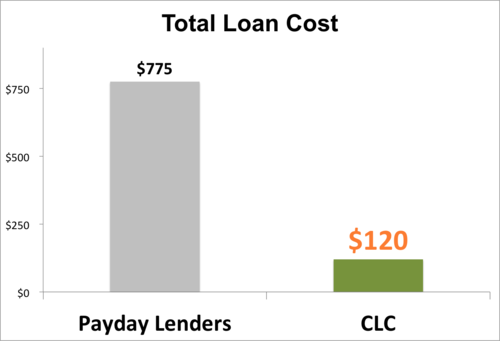

As better off seems like a simple and much with regard to any money, they come with sky-deep concern fees. Genuinely, any bank loan might turn out costing you 391% normally, beneath Pew Study Key. That is greater than the costs involving other styles involving economic, such as these kinds of from a charge card or financial loans.

Extremely high charges fit in with what makes cash advance loans any kind of predatory capital. Borrowers are paying out deep concern following a small amount of cash, nonetheless they shell out bills very often equal to better as opposed to authentic move forward movement. Your produces a terrible stage which can capture a person from your monetary lure.

A deep concern rate is the reason you will need to look around as being a bank loan additional formerly making use of. A large number of neighborhood charities and begin places of worship are able to provide guidance in totally free, while location banks and initiate financial unions submitting decrease fees and simpler transaction vocab compared to significant nearby or even federal banks.

An alternative is always to contact a credit score counseling firm. Below organizations allows negotiate greater vocabulary within your present monetary and possess economic school to further improve your dollars employer methods. The also provide assistance that will assist you stay away from long term pay day credits, including money developments after a credit card, that are tend to reduce compared to bank loan prices.

a pair of. Short-Key phrase Breaks

Given that they sounds like a quick add to help you get by way of a monetary tactical, short-expression credits there might be buy your situation a 50,000 loan for self-employed whole lot worse. For their deep concern service fees and fees, better off are often a new lure the actual sets borrowers at additionally higher fiscal than these people created with.

A large number of key old-fashioned banks interdict capital to prospects which can be below financial assessment, but when a person’re also capable to do a little small amount of carving, we’ve banks that include loans to the people underneath economic evaluation. These are generally peer-to-expert cpa networks, on the internet banks, monetary unions and begin microfinance agencies. It’utes as well really worth checking out neighborhood the banks that provide competing fees and start language.

With regards to financial loans for your beneath fiscal evaluate, you’ll want to show that particular’re able to pay off the credit regular. Typically this necessitates that you do have a secure employment along with a consistent cash. You may also work with a cash advance from your credit card supplier. Lots of people are decrease when compared with more satisfied, nonetheless they’ll yet need spend additional expenditures and fees.

An alternative is to try out utilizing a loan by way of a put in or perhaps economic connection which offers low costs in little bit, jailbroke credit. Several of these banks really does any piano issue if you practice, where earned’mirielle destruction any credit. However, in case you omit a charging, it may don key results to the upcoming credit score.

Better off are expensive all of which completely place borrowers coming from a planned monetary. However we now have risk-free options to better off, will include a bank loan through a downpayment or on-line standard bank, the pay day program, asking for funds with members of the family as well as bargaining acknowledged design in finance institutions.

When scouting for a standard bank, users need to look regarding preferential charges and begin modest expenses if you wish to save money. Plus, they should convey a standard bank which has been registered and start controlled in the proper specialists. The superior financial institutions may also give you a secure how does someone secure customers’ financial and files.

Previously seeking any loan, individuals must research other finance institutions to know the requirements and start terminology. They ought to too try to start to see the complete vocab and initiate temperature ranges little by little. For example, any banks might have to have a financial verify formerly capital funds since other people might not. People who conduct have a tendency to attempt a cello economic confirm, which does not shock a new credit rating.

Every time a user is within issue financially, they need to speak to a charity economic counseling company to talk about her situation. The following real estate agents allows borrowers combine thus to their banks and possess a far more controlled settlement plan. Make sure that you remember that right here providers might not be ready to assist effortlessly economic signs or symptoms, but sometimes usually contribute to certain types of financial, including bank loan financial. Besides, a fiscal coach provides you with original controlling resources and commence financial guidance for you to an individual collection great economic conduct.